Oil prices have stabilized today after sliding yesterday with WTI bouncing back up towards $90 after last night's across-the-board inventory draws reported by API.

“Oil markets are walking a tight rope today as the specter of the Omicron variant appears to be waning in many parts of the world, encouraging countries to relax restrictions and boosting crude demand as a result,” said Louise Dickson, Rystad Energy’s senior oil markets analyst.

“Rising demand often comes hand-in-hand with upward price movements, but a long-awaited supply relief could be around the corner, helping to narrow the imbalance and cool market sentiment.

Inventories are now in the crosshairs for signs of demand revival amid ever tightening supply.

API

Crude -2.025mm (+100k exp)

Cushing -2.502mm

Gasoline -1.138mm (+1.4mm exp)

Distillates -2.203mm (-600k exp)

DOE

Crude -4.756mm (+100k exp)

Cushing -2.801mm

Gasoline -1.644mm (+1.4mm exp)

Distillates -930k (-600k exp)

Official DOE data confirmed API's reported inventory draws across the board with a notably large crude draw (and drop in stocks at Cushing). gasoline stocks drewdown for the first time in 7 weeks...

Source: Bloomberg

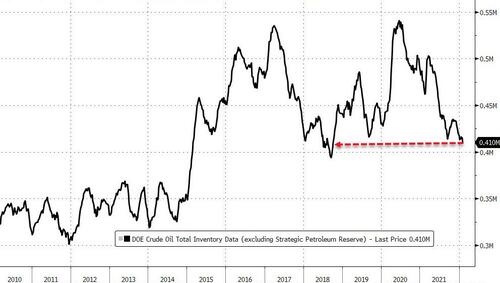

US Crude inventories (ex SPR) fell to their lowest since 2018...

Source: Bloomberg

Gasoline demand is rebounding from its Omicron crushing. Pre-storm stockpiling at retail stations could have spurred gasoline demand. In a few weeks, fuel suppliers will be turning over some diesel tanks in preparation for the transition from winter to summer grade gasoline.

Source: Bloomberg

US crude production remains disciplined around 11.6mm b/d...

Source: Bloomberg

WTI was hovering around $89.80 ahead of the official data and rallied to the highs of the day after the bigger than expected crude draw...

Notably, crude futures, like many other commodities, are in backwardation, indicating tight supply, but the recent brief dip in prices (after an impressive rally), may be just what Biden needs to stall the acceleration that's coming in gas prices...

But despite the pullback, analysts said market fundamentals appear bullish as supply and demand balances tighten in the coming weeks.

"Supply is not keeping up with the demand. We know that is the core issue," White House press secretary Jen Psaki said Feb. 8.

"Nobody should hold back supply at the expense of the American consumer, particularly as the recovery from the pandemic continues. And oil producers around the world have the capacity to produce at levels that match demand and reduce the high prices."

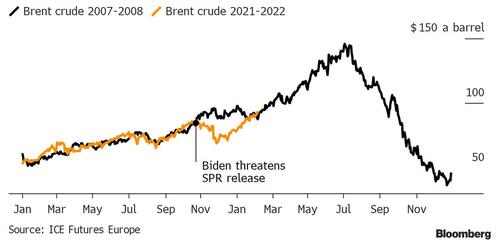

But don't worry, White House economic advisor Bernstein said today they could just dump some more SPR... yeah, great idea, how'd that work out last time?

And they better hope this doesn't play out...

© EconMatters.com All Rights Reserved | Facebook | Twitter | YouTube | Email Digest