The International Energy Agency and Goldman Sachs are both warning that global oil demand is facing headwinds due to the spread of the COVID-19 Delta variant: "Growth for the second half of 2021 has been downgraded more sharply, as new COVID-19 restrictions imposed in several major oil-consuming countries, particularly in Asia, look set to reduce mobility and oil use," the IEA said in its monthly report.

"We now estimate that demand fell in July as the rapid spread of the COVID-19 Delta variant undermined deliveries in China, Indonesia, and other parts of Asia," the IEA said.

Since July, NYMEX West Texas Intermediate (WTI) futures have fallen at least 10% as the Delta variant spreads worldwide. Traders are worried renewed lockdowns and or stricter social distancing measures in China, Europe, and the US may continue to weigh on oil demand and result in lower prices.

The "recent rally has lost steam on concerns that a surge in Covid-19 cases from the Delta variant could derail the recovery just as more barrels hit the market," the IEA said.

The agency said global oil demand "abruptly reversed course" last month, after surging by 3.8 million barrels a day in June, adding that it lowered consumption estimates for the second half of this year by 550,000 barrels a day.

However, the IEA projects in the last quarter of this year, the global economic recovery should regain steam as world fuel should reach an average of 98.9 million barrels a day.

Similar to IEA's forecast is a report from Goldman Sachs' Damien Courvalin, who told clients that "transient demand headwinds" have developed and there is "growing evidence of structural supply tailwinds."

Courvalin already lowered his emerging market demand expectations last month due to the Delta spread but at the time "omitted" China from the downgrade.

Now Courvalin has included China in the downgrade because the economy is slowing due to new restrictions and lockdowns. Here's what he said:

"While we had already lowered our EM demand expectations due to the Delta variant last month, we had omitted China, where we are now cutting our demand forecast by 1 mb/d over the next two months, double the estimated impact so far. With EU, LatAm and India demand surprising to the upside, the net impact from Delta on our global oil demand forecast remains moderate, keeping demand in the next two months at 97.8 mb/d vs. 98.4 mb/d realized in July. Our base case remains that the Delta wave will impact demand – including in China – for only two months, consistent with prior cycles, including most recently in India.

We had taken into account last month when we reduced our summer global demand forecasts by 1 mb/d, to flat from July levels. The impact of the Delta wave in South-East Asia has broadly progressed as we had expected so far, with passenger vehicle fuel impacts of 300-400 kb/d and a total hit of c.500 kb/d."

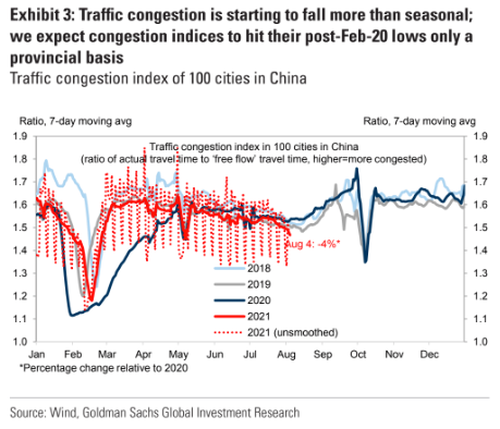

Using high-frequency data, the commodity analyst shows traffic congestion in China has slumped, which means fewer cars on highways, and in return, demand for crude products declines. Less congestion on Chinese roads is due to new government restrictions and lockdowns to mitigate the spread of the virus.

"Importantly, we currently estimate global oil demand at c. 98.2 mb/d, little changed from two weeks ago, as mobility continues to improve especially in Europe and LatAm and with Indian demand also beating expectations (and LNG prices likely creating some substitution to oil)," he said.

Courvalin said: "In aggregate, we now forecast August and September global oil demand at c. 97.8 mb/d, with 3Q21 expected only 0.8 mb/d lower than our pre-Delta expectations. Our base case remains that the Delta wave will impact demand – including in China – for two months, consistent with prior cycles, including most recently in India. We further assume that the efficacy of vaccines in avoiding severe cases will leave DM mobility mostly unaffected, especially since we had already tempered our international jet demand recovery."

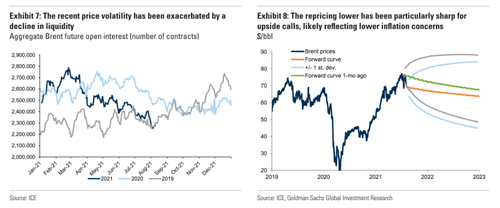

He said the lack of liquidity in Brent futures and the increasing skepticism of reflation/inflation trade had increased oil market volatility.

Joining the chorus of slumping oil demand are OPEC and its allies. In its latest monthly report, the oil cartel has cut demand for its crude in 2022 by 1.1m b/d amid a stronger production outlook.

"Amid this precarious outlook, the vigilance and determined efforts" of OPEC and its allies "will remain ever more important in striving to maintain a stable and balanced market." according to the cartel's monthly report.

The gloomy outlook comes as the Biden administration calls for OPEC to boost supplies and lower prices at the pump for Americans paying an arm and a leg for gas and diesel.

So the latest cut in the oil demand outlook appears to be "temporary" and has already weighed on prices since July. The question is, if governments around the world continue to reimpose lockdowns or strict social distancing measures which would lead to further oil demand declines, which may prompt OPEC to do precisely the opposite of what Biden is begging it to do.

Courtesy of Tyler Durden, founder of Zerohedge

© EconMatters.com All Rights Reserved | Facebook | Twitter | YouTube | Email Digest