Stocks are selling off again on Monday as worries about inflation persist, as the market is increasingly coming around to Morgan Stanley's view that inflation will be an endemic phenomenon of the V-shaped recovery engineered by the Fed and federal government.

The defining characteristic of the post-COVID recovery will be a period of high growth and higher inflation, diminishing the risk of secular stagnation. Whether this will ultimately force the Fed to taper their bond-buying and hike interest rates sooner than they otherwise might remains to be seen.

But in the latest installment of its new daily newsletter Supply Lines, Bloomberg highlighted the myriad evidence for an overheating economy, which we have been pointing out piece by piece, as prices have surged on everything from lumber (which thankfully for home builders has seen price pressures ease somewhat in recent days) to used cars, as new-car production is hampered by shortages of critical chips.

Even among low-tech products, firms are panic-buying inventory faster than suppliers can satisfy, a phenomenon that has been undoubtedly aggravated by worker shortages. And last week's hot CPI print was perhaps the confirmatory sign the market needed to drive home the point that these rising prices are already being passed on to consumers, even if companies are loath to admit that.

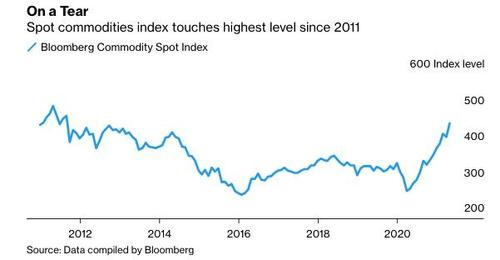

And it's not just lumber: the BBG spot commodities index is at its highest level since 2011.

Source: BBG

Because as BBG implies, this situation is truly unique, differentiated from earlier supply shocks by "the sheer magnitude" of it.

Copper, iron ore and steel. Corn, coffee, wheat and soybeans. Lumber, semiconductors, plastic and cardboard for packaging. The world is seemingly low on all of it. “You name it, and we have a shortage on it,” Tom Linebarger, chairman and chief executive of engine and generator manufacturer Cummins Inc., said on a call this month. Clients are “trying to get everything they can because they see high demand,” Jennifer Rumsey, the Columbus, Indiana-based company’s president, said. “They think it’s going to extend into next year.”

The difference between the big crunch of 2021 and past supply disruptions is the sheer magnitude of it, and the fact that there is — as far as anyone can tell — no clear end in sight. Big or small, few businesses are spared. Europe’s largest fleet of trucks, Girteka Logistics, says there’s been a struggle to find enough capacity. Monster Beverage Corp. of Corona, California, is dealing with an aluminum can scarcity. Hong Kong’s MOMAX Technology Ltd. is delaying production of a new product because of a dearth of semiconductors.

This situation has been exacerbated by an unlikely amalgam of circumstances: the pipeline hack, snow in Texas that paralyzed the state's economy, droughts wrecking crops. And indicators show that our countries logistics experts are bracing for these shortages to continue for the next year. For evidence of this, BBG points to an obscure gauge called the "Logistics Managers' Index", which is based on a survey of corporate supply managers.

Source: BBG

One academic who helps compile that index said what he's seeing is nothing short of a "paradigm" shift into our new reality:

To Zac Rogers, who helps compile the index as an assistant professor at Colorado State University’s College of Business, it’s a "paradigm shift." In the past, those three areas were optimized for low costs and reliability. Today, with e-commerce demand soaring, warehouses have moved from the cheap outskirts of urban areas to prime parking garages downtown or vacant department-store space where deliveries can be made quickly, albeit with pricier real estate, labor and utilities. Once viewed as liabilities before the pandemic, fatter inventories are in vogue. Transport costs, more volatile than the other two, won’t lighten up until demand does.

“Essentially what people are telling us to expect is that it's going to be hard to get supply up to a place where it matches demand," Rogers said, “and because of that, we’re going to continue to see some price increases over the next 12 months."

The supply shortage runs surprisingly deep. For example, Bloomberg found a small company that manufactures crib mattresses, which is struggling with shortages of foam padding that it uses to make its products. Why will this panic persist? Because panic breeds panic: as the cribe-maker quipped: "Everybody is going to overbuy it." they said.

Caught in the crosscurrents is Dennis Wolkin, whose family has run a business making crib mattresses for three generations. Economic expansions are usually good for baby bed sales. But the extra demand means little without the key ingredient: foam padding. There has been a run on the kind of polyurethane foam Wolkin uses — in part because of the deep freeze across the U.S. South in February, and because of “companies over-ordering and trying to hoard what they can.”

“It’s gotten out of control, especially in the past month,” said Wolkin, vice president of operations at Atlanta-based Colgate Mattress, a 35-employee company that sells products at Target stores and independent retailers. “We’ve never seen anything like this.”

Though polyurethane foam is 50% more expensive than it was before the Covid-19 pandemic, Wolkin would buy twice the amount he needs and look for warehouse space rather than reject orders from new customers. “Every company like us is going to overbuy,” he said.

Perhaps the only upside of this is that if COVID-19 does make a mutant-assisted resurgence, warehouses will be well-stocked for the next shutdown.

© EconMatters.com All Rights Reserved | Facebook | Twitter | YouTube | Email Digest